Investment Strategies

Apart from a well-founded investment and consultation process, to

participate successfully in various forms of investments requires access

to a wide variety of products and services. The diagrams presented

below refer to the six traditional asset allocation strategies, and show

an example within each strategy. Alternative investments, such as gold,

can be added.

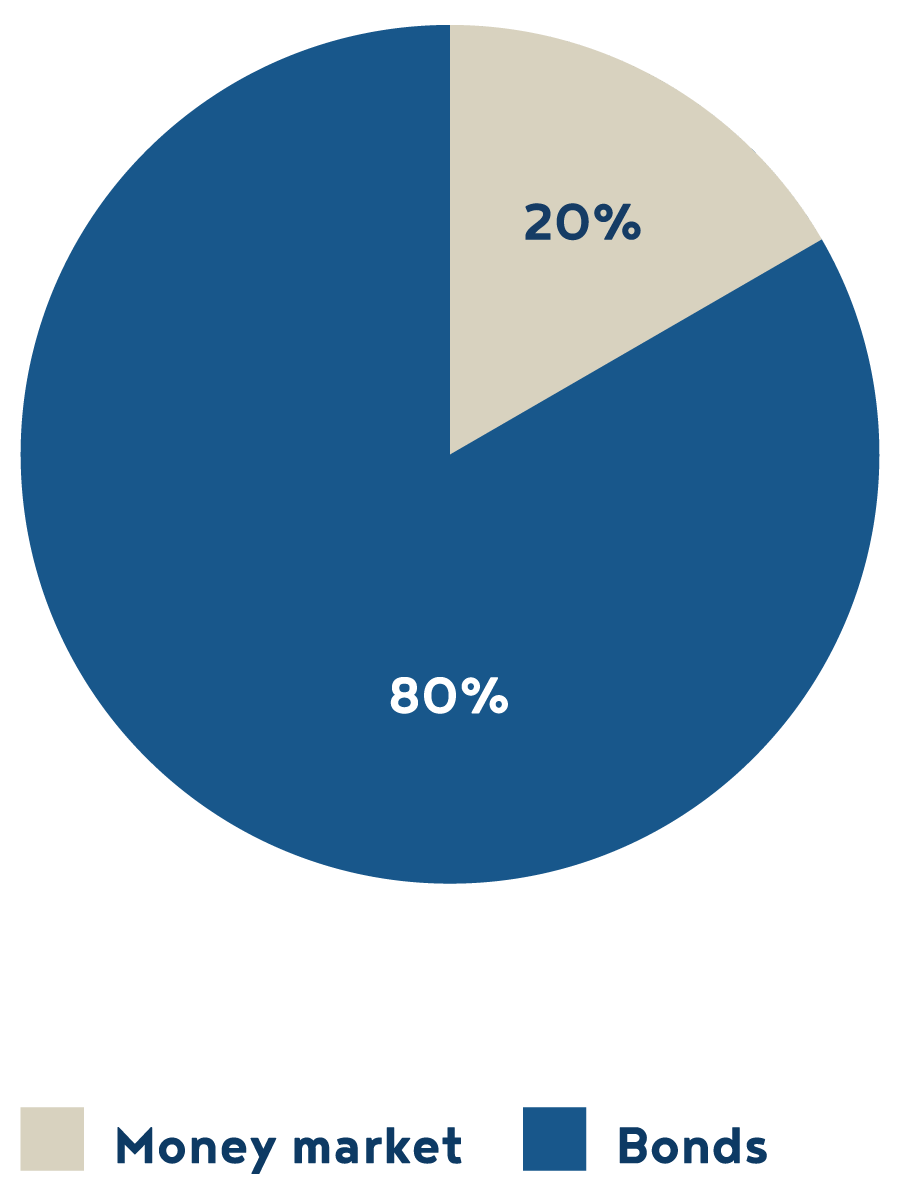

Investment strategy: Fixed interest rate

very conservative

Risk propensity

Risk profile and investment objective

Proposed investment strategy

Asset allocation (normal fluctuation margins)

Client reluctant towards risks

No avoidable risk for client’s assets (secure investment)

Change in interest rates may lead tofluctuations in price

Fixed interest rate (very conservative)

Asset Preservation

Constant revenue through interests

Money Market: 0-20%Bonds: 80-100%Alternative Investments: variableHolding period: Min:. 2 years

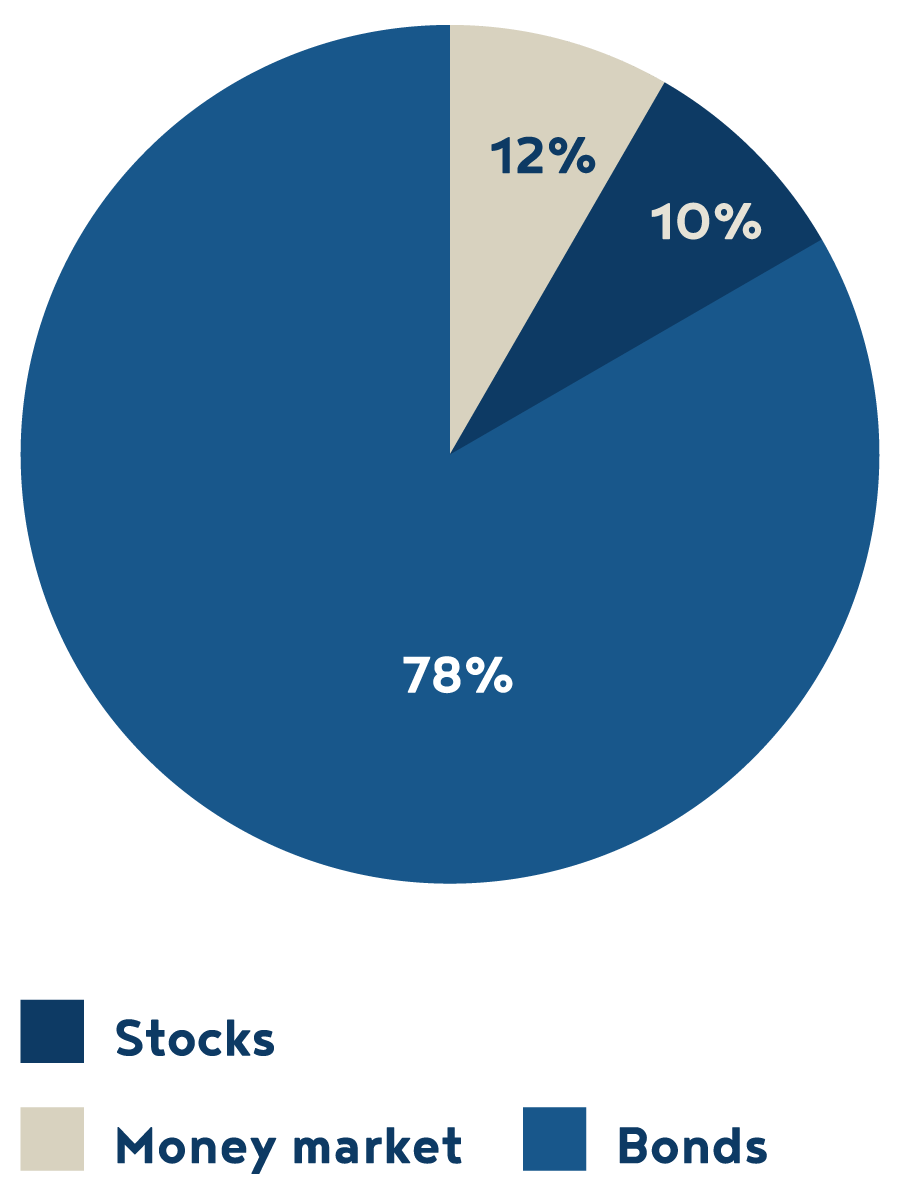

Investment strategy: Income

conservative

Risk propensity

Risk profile and investment objective

Proposed investment strategy

Asset allocation (normal fluctuation margins)

Customer is more risk-averse

Limited risk to achieve increased return on assets from a long term point of view

Interest rate change can lead to price fluctuation

Income (conservative)

Long-term real asset preservation with small price fluctuations

Regular income from interest received is optimized through dividends and capital gains

Money Market: 0-20%Bonds: 68-88%Stocks: 4-20%Alternative Investments: variableHolding period: Min:. 2 years

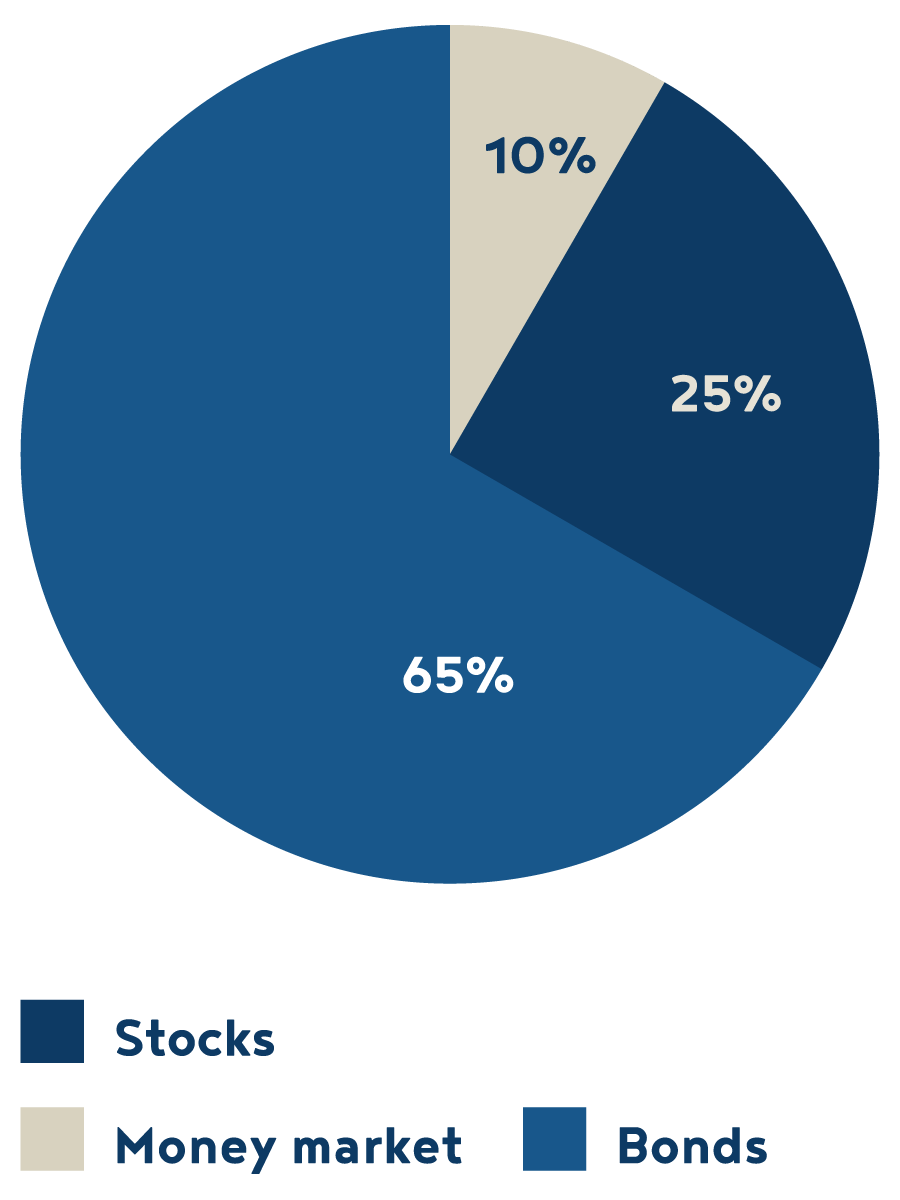

Investment strategy: Return on investment

moderate

Risk propensity

Risk profile and investment objective

Proposed investment strategy

Asset allocation (normal fluctuation margins)

Customer is cautious about risks

Calculable risk to generate long-term additional income from capital gains

Interest rate change can lead to Course fluctuation

Return (moderate)

Return-oriented portfolio for long-term real asset growth with moderate price fluctuations

Primary sources of income through interest and dividend receipts, supplemented by capital gains

Money Market: 0-20%Bonds: 55-75%Stocks: 15-35%Alternative Investments: variableHolding period: Min:. 4 years

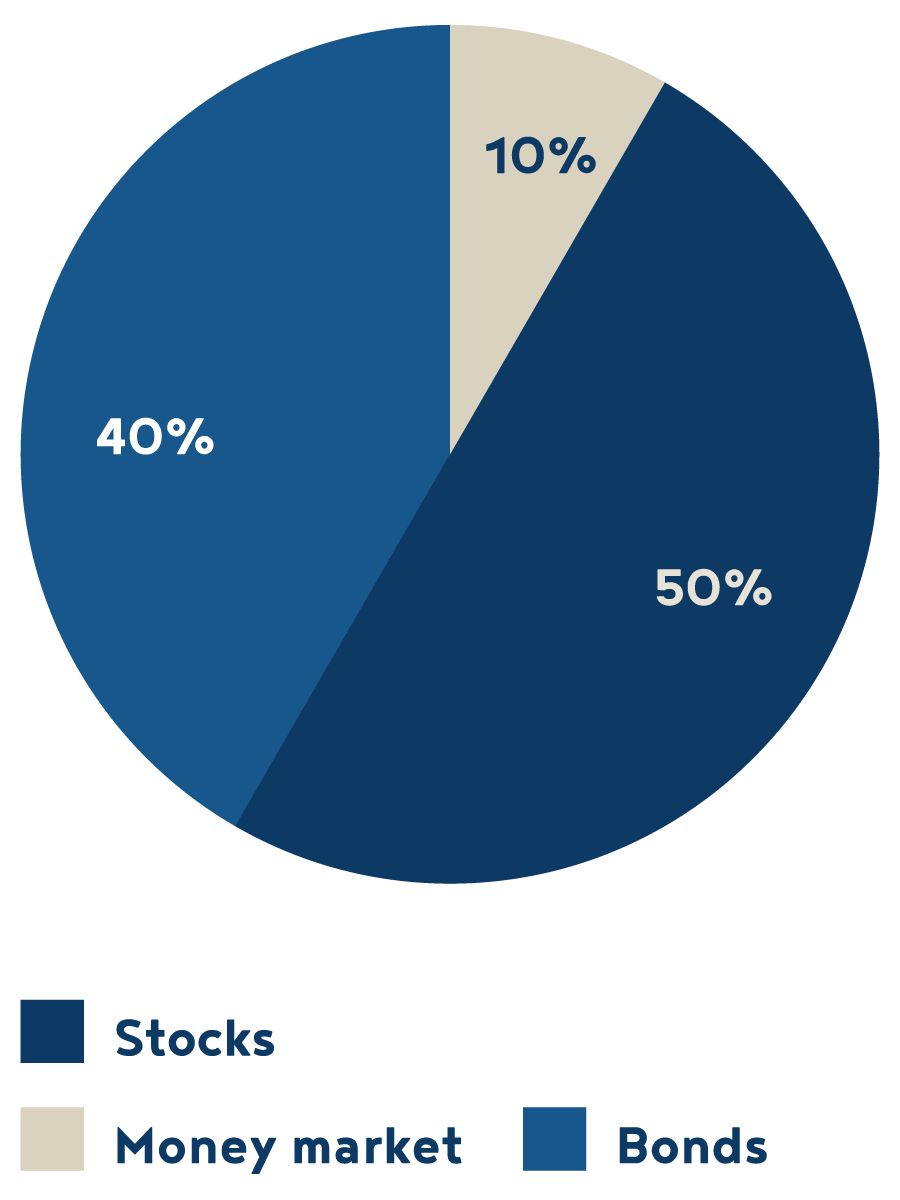

Investment strategy: Balanced

liberal

Risk propensity

Risk profile and investment objective

Proposed investment strategy

Asset allocation (normal fluctuation margins)

Customer perceives risk as an opportunity

Attractive income seen from a long term perspective

Balanced portfolio

Long-term real asset growth

Price fluctuations possible

Income from interest and dividend receipts and capital gains

Money Market: 0-20%Bonds: 30-60%Stocks: 35-65%Alternative Investments: variableHolding period: Min:. 6 years

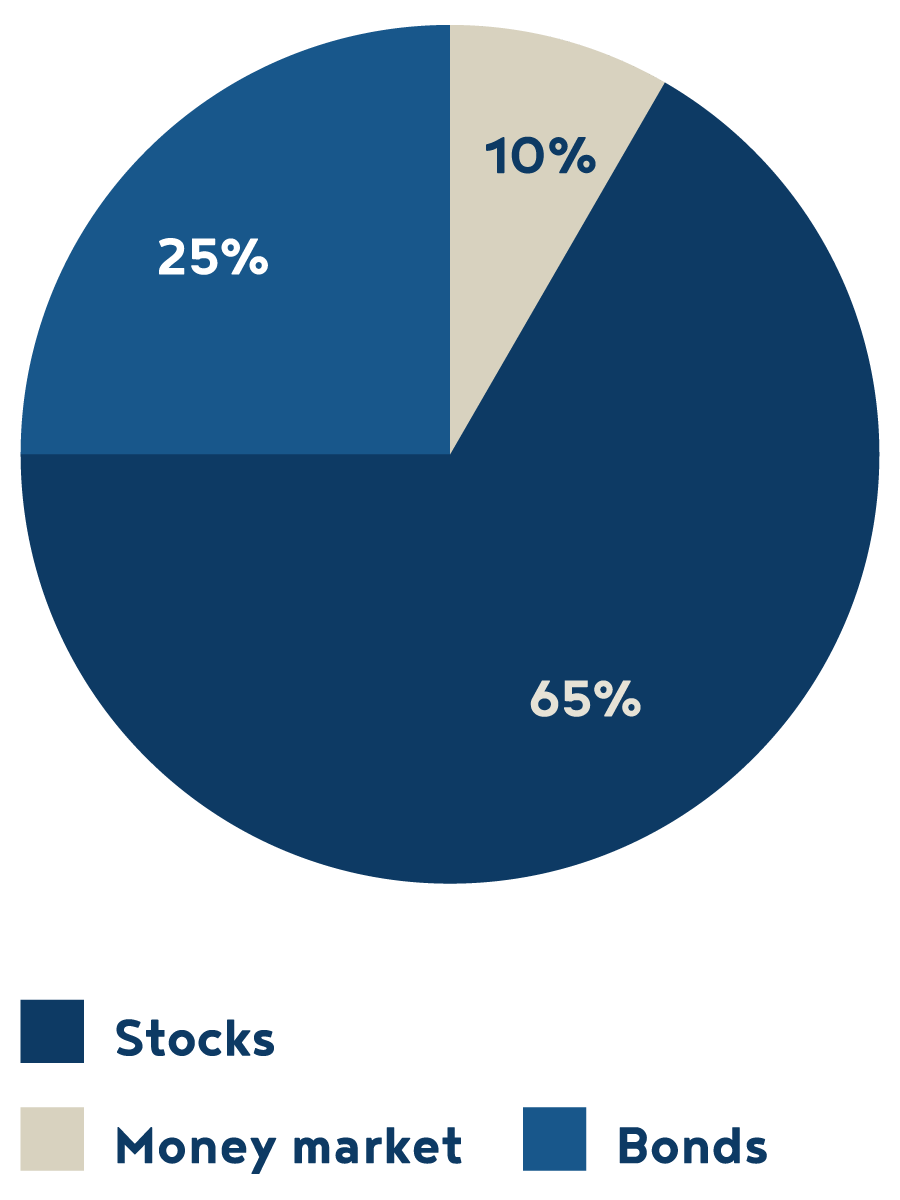

Investment strategy: Growth

dynamic

Risk propensity

Risk profile and investment objective

Proposed investment strategy

Asset allocation (normal fluctuation margins)

Customer wants to participate in the profit potential of the stock markets

Short-term large price fluctuations possible

Growth (dynamic)

Long-term view: significant real asset growth

Bigger price fluctuations possible

Income through capital gains, interest and dividend receipts

Money Market: 0-25%Bonds: 10-40%Stocks: 50-80%Alternative Investments: variableHolding period: Min:. 8 years

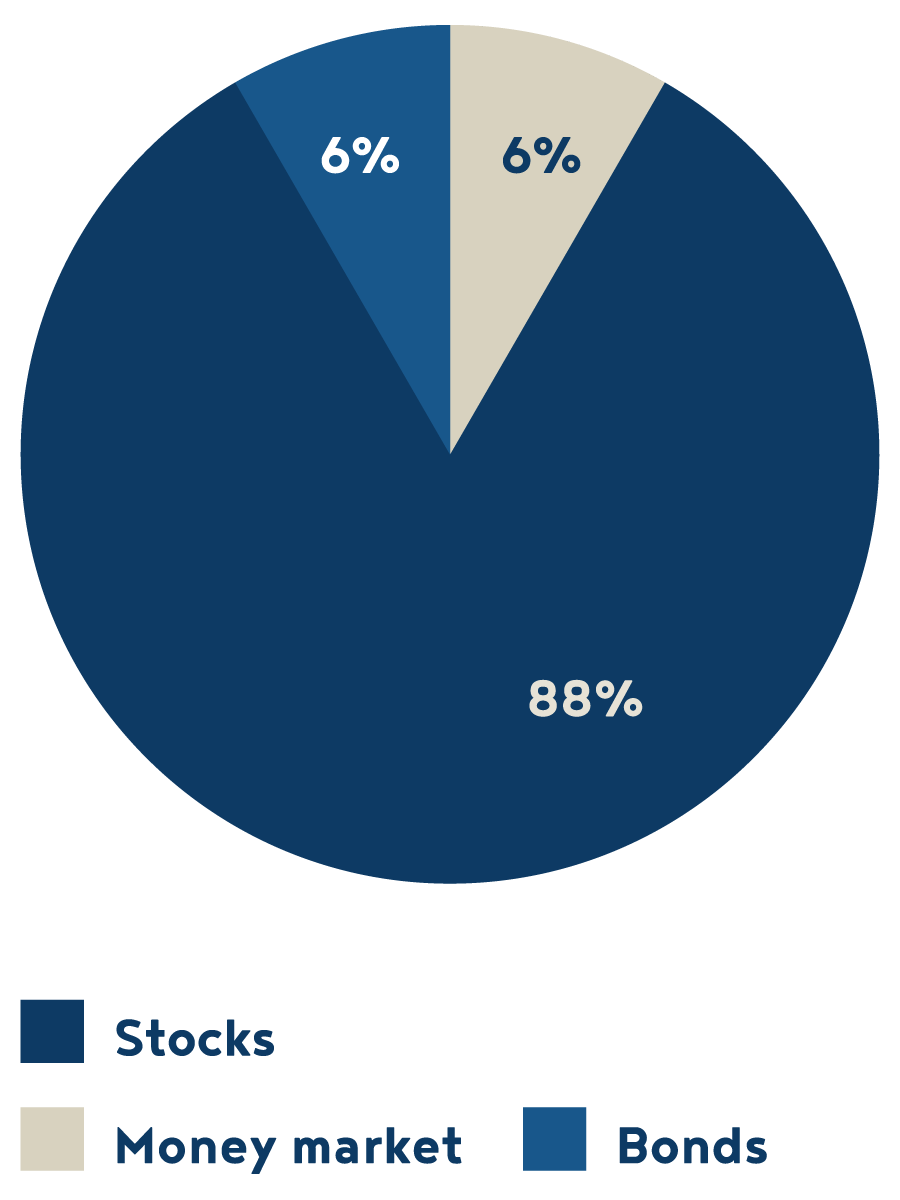

Investment strategy: Stocks

offensive

Risk propensity

Risk profile and investment objective

Proposed investment strategy

Asset allocation (normal fluctuation margins)

Customer is willing to take risks

Long-term profit opportunities

For long-term above-average returns

Above average value fluctuations possible

Stocks (offensive)

Most risky investment strategy

Long-term, large real asset growth

Predominantly equities (large fluctuations possible)

Capital gains and foreign exchange movements are the main revenue

Money Market: 0-25%Bonds: 0-25%Stocks: 75-100%Alternative Investments: variableHolding period: Min:. 10 years

Your assets in good hands Investment Strategies

A carefree future Retirement Planning

Contact us +423 388 01 50